will the irs forgive my debt

Do note that even if the IRS accepts your installment plan. Your non-refundable payments and fees are applied to the tax liability you may designate payments to a specific tax year and tax debt IRS may.

Irs Fresh Start Program Services Lifeback Tax

Does IRS forgive tax debt after 10 years.

. To assist you in reporting your canceled debt the lender is required to provide you with a Form 1099-C Cancellation of Debt showing the canceled debt and any interest that. There are four main forgiveness programs accessible to taxpayers. While the rule exists in the IRS rule book for IRS debt forgiveness it can take a long time with much hassle along the way to score.

The IRS approves cases for qualified applicants who can furnish valid documentation that supports their claim. The typical period that the IRS allows is around 72 months and you cant owe less than 50000 in combined tax penalties and interest. Some tax debt relief.

The fate of student loan debt forgiveness is still uncertain but you can still apply for up to 20000 in relief. However some crucial exceptions may apply. Limitations can be suspended.

IRS Debt Forgiveness is basically paying less than you owe to the IRS getting part of the debt forgiven. As a general rule of thumb the IRS has a ten-year statute of limitations on IRS collections. The quick answer is yes.

IRS debt relief is for those with a debt of 50000 or less. IRS Debt Forgiveness Myth or Legitimate. After that the debt is wiped clean from its books and the IRS.

An income cap of 200000 for married couples filing. What Is IRS Debt Forgiveness. A tax balance below 50000.

In order to qualify for an IRS Tax Forgiveness Program you first have to owe the IRS at least 10000 in back taxes. Installment agreement The most common repayment period is 72 months. However it is advisable to seek expert help to gain forgiveness.

While IRS evaluates your offer. An income cap of 100000 for single filers. Who Is Eligible for IRS Tax Debt Forgiveness.

Who qualifies for IRS debt forgiveness. The most common types of tax debt forgiveness are. Look at what every taxpayer.

This proposition is not a forgiveness program but it. Do you want to know if you may get your IRS bill forgiven. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt.

Tax debt forgiveness is available if your solo income is below 100000 or 200000 for. Katie is a writer covering all things how-to at CNET with a focus on. Who qualifies for IRS forgiveness.

Then you have to prove to the IRS that. The IRS recommends this if. IRS debt forgiveness refers to several tax relief programs offered by the IRS to help taxpayers resolve their back taxes.

Tax Debt Forgiveness How To Get Your Tax Debt Forgiven Debt Com

Irs Debt Forgiveness Program Are You Eligible Tax Relief Center

Does The Irs Forgive Tax Debt After 10 Years Heartland Tax Solutions

Credit Card Debt Forgiveness Is It Actually Possible Tayne Law Group

Owe The Irs You Have A Few Options If You Cannot Afford The Bill Forbes Advisor

Do I Owe Taxes On My Debt Forgiveness Form 1099c Cancellation Of Debt

If You Have Tax Debt Here Are 5 Tips To Set Things Right With The Irs

How Can The Irs Fresh Start Program Help Me Maryland Tax Attorney

Irs Debt Forgiveness Program Tax Group Center

Will The Irs Settle My Tax Debt Rogers Russell

How To Get Tax Amnesty A Guide To The Forgiveness Of Irs Debt Including Penalties Interest Daniel J Pilla Paul Engstrom 9780961712495 Amazon Com Books

Does The Irs Offer One Time Forgiveness Tax Debt Advisors

What Happens To Federal Income Tax Debt If The Person Who Owes It Dies

How Much Will The Irs Usually Settle For Offers In Compromise Faq

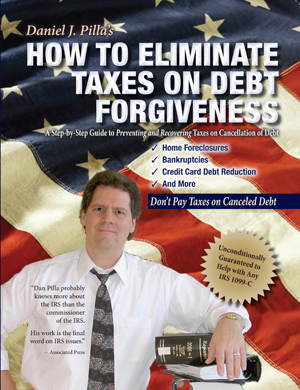

How To Eliminate Taxes On Debt Forgiveness Tax Problems Solved Dan Pilla

Irs Courseware Link Learn Taxes

I Owe The Irs 14 000 And I M Freaking Out Youtube